The government recently hired a firm called Gryphon Scientific to analyze how well the stockpile could respond to a range of health disaster scenarios.

The warehouse Greenfieldboyce visited contains 130 shipping containers, but who will be on the receiving end of these shipping containers during an actual emergency?

“While they do have plans for emergencies, and lists of volunteers, they’re volunteers,” said Paul Petersen, director of emergency preparedness for Tennessee. “And they’re not guaranteed to show up in the time of need.”

While the mainstream media propagandists continue to push the lie of a robust recovering economy, the fact is, we are in some serious fiscal trouble. Economies around the world are crashing, countries are drowning in record amounts of debt, and governments continue to pile on new debt like there’s no tomorrow.

What is an Economic Collapse?

Economic collapse, in its simplest definition, means a sudden and severe drop in currency value, leading to a financial crisis. It usually happens when the country’s economic activities are mismanaged or when an unexpected event throws the country into chaos. Some examples of such events are terrorist attacks, natural disasters, political upheaval, severe social unrest, financial bubbles , a collapse in government, and pandemics.

A look at Prior Economic Disasters, Depressions and Market Collapses

Throughout the history of the world, there have been many instances where countries have experienced an economic collapse, leading to severe consequences such as hyperinflation, high unemployment rates, and poverty. In extreme cases, economic collapse can even lead to a societal breakdown, with people experiencing shortages, social unrest, and struggling to survive.

The earliest recorded economic collapse occurred in 176 BC when the Roman Republic experienced a severe financial crisis that eventually led to massive inflation and debasement of the currency. The government’s response to this crisis was to issue more coins with decreased silver content, resulting in worsening hyperinflation and a sharp decline in the purchasing power of its citizens. This eventually led to social unrest and political instability, eroding the strength of the Roman Empire over time.

Another significant economic collapse occurred during the Great Depression of the 1930s, triggered by the stock market crash of 1929. During this period, businesses failed, banks collapsed, and unemployment soared to unprecedented levels worldwide. The depression had far-reaching negative consequences, some of which ultimately led to World War II.

In 1997, the Asian Financial Crisis rocked Southeast Asia, causing widespread economic instability and social unrest. The crisis began with the devaluation of the Thai baht, leading to investors withdrawing their capital from other Southeast Asian countries. This, in turn, led to a sharp decline in the value of their currencies and an economic recession. As a result, millions lost their jobs, and poverty rates rose steeply. Some nations recovered relatively quickly, while others, such as Indonesia, suffered profound economic and political upheaval for several years

The most recent collapse occurred in 2008 when the subprime mortgage crisis shook the global financial markets. The crisis began with predatory lending practices by mortgage lenders, high-risk borrowing by homeowners, and the buying and selling of risky loans between financial institutions. When homeowners began to default on their mortgages, banks and insurance companies suffered huge losses, and trust in the financial system evaporated almost overnight. As a result, governments worldwide were forced to intervene to avoid a total collapse of the financial system.

As history shows, it’s not if but when! Therefore, preparing for an economic collapse is vital to your survival, especially in today’s world, where the global economy is interdependent. Any event, even those in other parts of the world, can have a ripple effect on other countries. This article will provide tips on how to prepare for economic collapse.

Are we heading towards an Economic Collapse?

At some point this debt train is going to come to a screeching halt; when that happens we are going to see panic and chaos like nothing we’ve ever seen before.

As we’ve been covering for some time now, a look at the numbers and data shows we are heading for a potential disaster. From a series of high profile banks going bust to record inflation combined with major supply chain shortages, our economy seems to be heading right off the cliff.

The world, especially the United States, is drowning in debt.

The United States, once the world’s shining example of fiscal security and responsibility, has become shackled by a record amount of debt. We are literally drowning in debt.

Over the next ten years, experts think that debt could balloon to over $50 trillion. While that might seem like an insurmountable amount of debt to recover from, the fact is, we have already surpassed that number many times over.

When factoring in unfunded liabilities like Social Security, Medicare, government pension plans and Obamacare, the true debt number is actually much higher. Estimates put the real number somewhere between $222 trillion to $250 trillion.

But it’s not just the government, people are borrowing at record levels as well.

- Household debt increased at the fastest pace in 15 years, partially due to huge increases in credit card usage and mortgage balances.

- Credit card balances rose more than 15% from 2021, the largest annual jump in more than 20 years.

- Total Consumer Debt is now over $2.36 Trillion, an increase of 7.3 per cent in Q3 2023 compared to last year.

The overall Economic numbers are downright Scary!

- Silicon Valley Bank Collapse causing fears of market contagion and Bank Runs

- Stock & crypto markets crash, U.S. debt to soar past $50 trillion within 10 years as Biden to Raise Taxes

- Commercial Real Estate Collapse Latest Warning Sign to Prepare for Major Economic Troubles

- Food Shortages: American Food Supply in Real Danger, expected to get worse in 2023

- US inflation surges as economy becomes top preparedness threat

- U.S. money supply, which measures safe assets households and businesses can use to make payments, has fallen abruptly since March and is negative on a yearly basis for the first time since 2006.

- Mortgage payments as a share of income have doubled from 13% to 26%, and the savings rate has plummeted to almost zero.

- Total household debt increased by 8.5% in 2022 and now stands at a record $16.9 trillion. That’s $2.75 trillion higher than it was pre-pandemic.

- Sales of commercial mortgage bonds have taken a nose dive, plummeting about 85% year-over-year as commercial real estate investors are bracing for what looks like a wave of defaults throughout the commercial real estate industry.

What can you expect during a major Economic Collapse?

- A Run on the Banks: One of the first things you will see is a run on the banks. People are going to be panicking, and they will be doing everything they can to get their hands on cash to buy extra supplies.

- Chaos in the Streets: Once the banks run dry, you will see people turn desperate. The moment they realize the money is gone is the moment you will see widespread chaos sweep throughout the country. Riots, looting, and widespread violence will break out, making self-defense one of your primary concerns.

- Martial Law: When things start to go bad, I believe you will see the government declare a state of emergency or Martial Law. When this happens you will see things like travel restrictions, mandatory curfews, and the suspension of Constitutional rights.

So what should you do to prepare for an economic collapse?

- Are you prepared to survive a total economic collapse?

- If you haven’t already, it’s time to put together a plan of action. The fact is, the writing has been on the wall for some time now, and we probably don’t have much time left.

- If and when things go bad, and money starts to become scarce, do you have a plan? What if we suffer a complete meltdown and collapse of the economy?

I devoted an entire section to financial preparedness and the coming collapse of the economy in my book, The Ultimate Situational Survival Guide; because I firmly believe it’s one of the most serious threats we face.

The first thing you need to do is Develop a Plan of Action.

The first step in preparing for an economic collapse is to have a plan. You should have a clear idea of what to do in case of a financial crisis. This plan should include steps you would take to protect yourself and your family.

A good starting point would be to have some emergency savings. These savings should be enough to cover your living expenses for at least six months. This could be in cash, precious metals, or other assets that can hold value during a financial crisis.

Another important aspect of your plan should be to have a source of income not affected by the collapse. This could be through investing in assets that will not lose value during a crisis, such as gold or silver (or good ol beans and bullets!). Alternatively, you could start a side business that provides a steady income stream.

If things go bad, having a plan of action will help increase your chances of surviving the chaos. Check out my list of Essential Preparedness Tips, Skills, and Resources to Prepare for Disasters & Threats.

Start being Smart with your Money

During the 2008 financial collapse, millions of Americans lost their homes, cars and personal possessions because they saddled with debt. Since the so-called COVID pandemic, that trend has begun again with millions of people who now owe more on their property than they are worth, a vehicle repo market that is exploding, and consumer dent that is at record highs.

- If you can get out of debt, do it now. Start cutting all non-essential expenses, and use that money to pay down your debt. During an economic collapse, the likelihood of losing your home to debt collectors is a very real prospect.

- Start an Emergency Fund: Just like all areas of preparedness, there are steps you can take to insulate yourself from problems. Having an emergency fund is one way to prepare for financial troubles. It will give you a bit of a cushion during hard times, and can provide you with a fund to buy last minute supplies once things start to go bad.

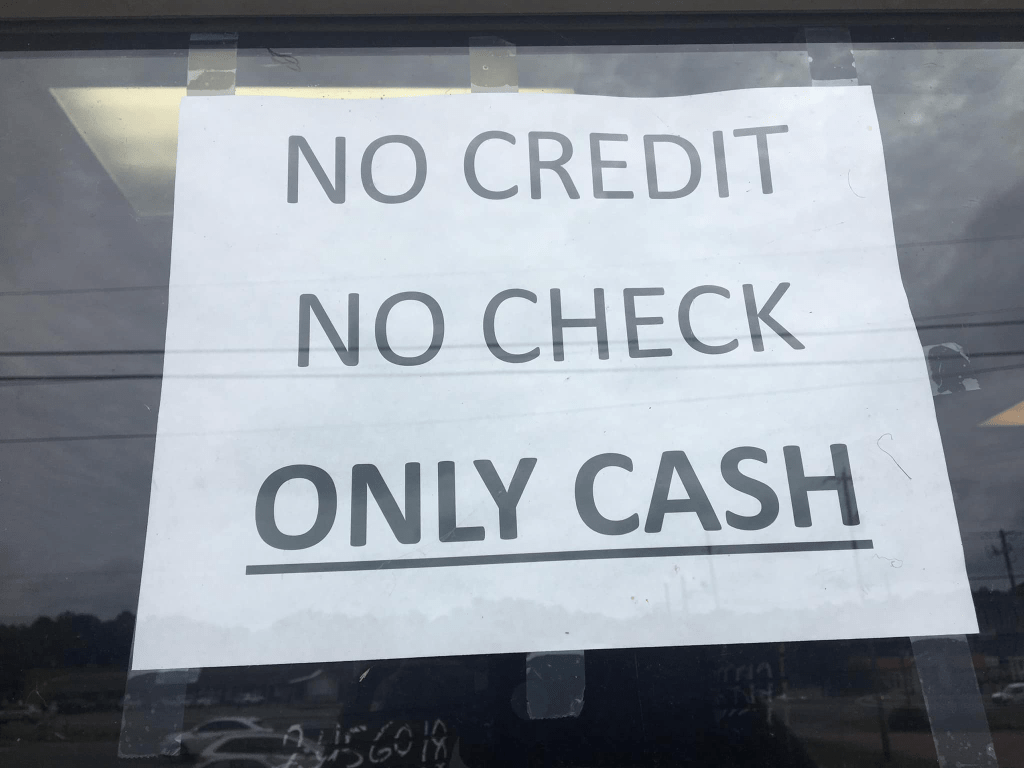

- Always have Cash on Hand: Once things start to go bad, there is a very real possibility that the banks may freeze or seize your accounts. Should there be a run on the banks; people are going to be desperate to get their hands on some cash. Even during a total economic collapse, paper currency will still play a major role in how people buy and sell during the initial phases of the crisis – especially if a bank holiday is declared.

Start Prepping for Problems NOW.

Now is the time to really start taking a serious look at your overall level of preparedness. The economy has been teetering on the edge of collapse for quite some time, throw in inflation that has almost doubled the price of staple goods and the growing social unrest that’s sweeping the country and you have yourself a real recipe for disaster.

- Put together an emergency kit that includes extra food & water, clothing, a portable shelter (tents, tarps, sleeping bags.), and a way to defend yourself.

- Think about what things are unique to your situation; items like medications, or supplies that you would be hard pressed to live without, should be stockpiled in preparation for economic troubles.

- For more information on prepping, check out our article on the top ten prepping tips for every SHTF situation. Every one of those tips can help prepare you to deal with an economic crisis.

Start stocking up on Survival Supplies.

During an economic collapse, supply chain disruptions and shortages of essential supplies are possible. Therefore, it is essential to stockpile some essential supplies to tide you over during the crisis. Now is the time to buy the things you need! I’m not talking about T.Vs or IPads; but instead, long-term supplies that you will need in order to survive in the future.

- Start stockpiling food and long-term consumables. During any type of crisis, food, water and long-term consumables are going to be worth their weight in gold. During an economic collapse, you will likely see major supply chain shortages and problems, making these types of supplies one of your most important pre-collapse considerations.

- Put together a Bug Out Bag: Should this country face an economic collapse, chances are pretty good it will be followed by riots, violence and something much uglier than the initial collapse of the economy. You should have a Bugout bag filled with everything you need to survive a prolonged emergency situation.

- Keep a good supply of First-Aid & Medical Supplies on Hand. Medical and personal hygiene supplies are going to be hard to come by when things go bad. Make sure you have everything you need to deal with medical emergencies.

- Some of the critical supplies you should consider stockpiling include food, water, medicine, and toiletries. You should also have a backup power source, such as a generator or solar panels, in case of power outages and infrastructure breakdowns.

Grocery Options that ship right to your Home:

- Amazon Fresh

- Bulk Emergency Foods

- Amazon Grocery

Pay Off Debt

One of the biggest challenges during an economic collapse is debt. High levels of debt can be a significant burden during a financial crisis, especially if you lose your source of income.

Therefore, paying off any high-interest debt before a financial crisis hits is essential. This will help reduce your monthly expenses and free up money you can use for other essential things.

If you have a mortgage, it may be wise to consider refinancing to a fixed-rate mortgage, which can provide some stability during the crisis.

Start Stocking up on Survival Knowledge.

Even more important than supplies, is survival knowledge. Knowledge is the key to your survival, and now is the time to get some. During any kind of disaster, including an economic collapse, knowledge is going to be your most powerful ally.

During a crisis, the skills that are in demand may change, and having a wide range of skills can increase your chances of finding employment or starting a new business. Some valuable skills to learn are gardening, carpentry, welding, and plumbing. These skills can help you make repairs or grow your food, saving you money and keeping you self-sufficient during a crisis.

Additionally, learning new skills can also increase your current earning potential, which can help you build your emergency savings or invest in assets that will hold value during a crisis.

- Start reading books on survival and start collecting information on how to live a more self-reliant lifestyle.

- Subscribe to our RSS feed to stay up-to-date on all the latest economic threats and preparedness information.

- Start doing your own Research. I don’t rely on government spun stories, or skillfully crafted press releases; I do my own research and you should too!

Take a serious look at your Self-Defense.

One of the biggest threats you’re going to face during an economic crisis is the threat posed by people. The social unrest and riots we’ve witnessed over the last couple of years are going to pale in comparison to what we’ll see during a full-scale economic collapse.

- Take a serious look at gun ownership, and learn everything you can about self-defense. When things go bad, you are going to need a way to protect yourself and those you love.

- Watch for signs of social unrest, and stay alert to what’s going on in your neighborhood and throughout the world.

- During an economic collapse, problems like home invasions and burglaries are going to become a real problem. Start looking into ways to strengthen your home’s security.

Preparing for an economic collapse can be challenging, but it is essential in today’s uncertain world. By having a plan, diversifying your investments, stockpiling essential supplies, learning new skills, and paying off debt, you can increase your chances of surviving and thriving during a financial crisis.

An economic collapse is a very real threat, one that has far-reaching consequences that you must take seriously. If you haven’t put together a game plan, what are you waiting for?

While nobody here is making any specific predictions, and I certainly can’t tell you that it’s going to happen on this date, in this year; I can tell you that the possibility is very real, and the reality of the situation is our politicians and leaders continue to put policies in place that ensure some very real future problems.